Competitors Who Aren't

Introduction

Everyone wants to build a product that is “future-proof”. But what does building something “future-proof” really mean? Does it mean that it will seamlessly translate to the next technological revolution? That people will still be using it in 50 years? That it meets a persistent need that will never go away?

These ideas are great ways to future-proof your product, but none of them matter if someone advances into your market and takes your customers. Your future-proofed product also means nothing if you can’t acquire users in a large enough market to stay relevant. As a product manager, your job is to ensure your product not only solves the customer’s problem today, but that it makes your company money and maintains its viability for your users long into the future.

Defining Your Market Space

One of the main things that must be done after a product manager has defined the problem space is to determine who the target market is, or define your market space. This step is critical to finding a problem that is both worth solving now and that will stick around for a while.

Defining your market space is limiting your scope to a selected group of users that you can sell your product to. These are the people that you make user personas of and the people that have your sales team knocking on their door. Every successful company starts out with a small, niche market and grows from there. Companies and products that try to boil the ocean in their first iteration and go-to-market plan will fail. They will be everything to everybody and nothing to nobody.

Instead, what you need to be is everything to somebody. Then you can grow into being everything for somebody+1, somebody+2, somebody+n. And if you start small, and grow your market space effectively, you will be the big dog and have the largest market share.

Why you need to start small: a short digression into business strategy

Peter Thiel famously coined the phrase “competition is for losers”. His main point is that competition, while valuable in determining that you have found something users want and is enough to take a bet on, will kill your company. You don’t want competition, you want a monopoly.

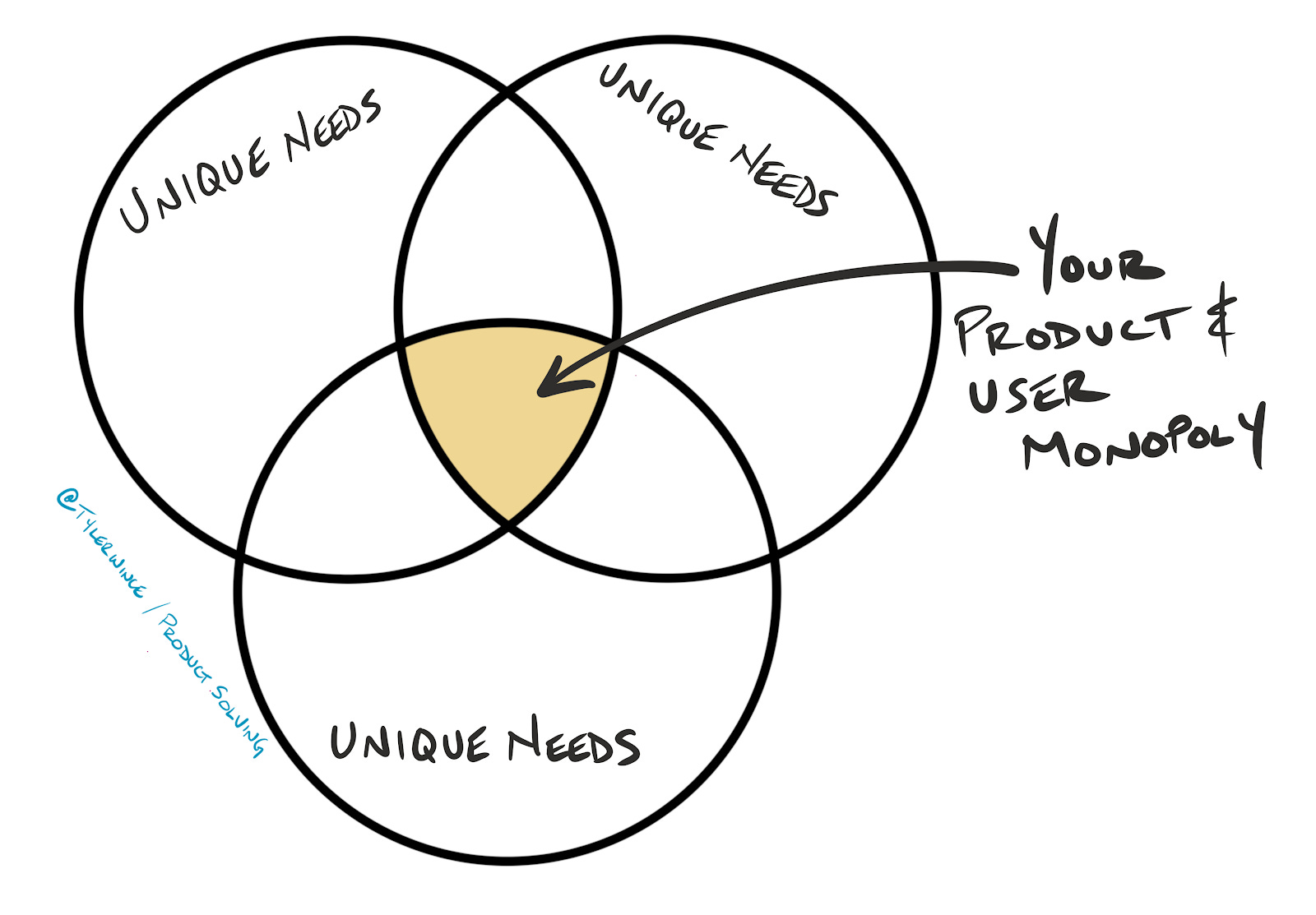

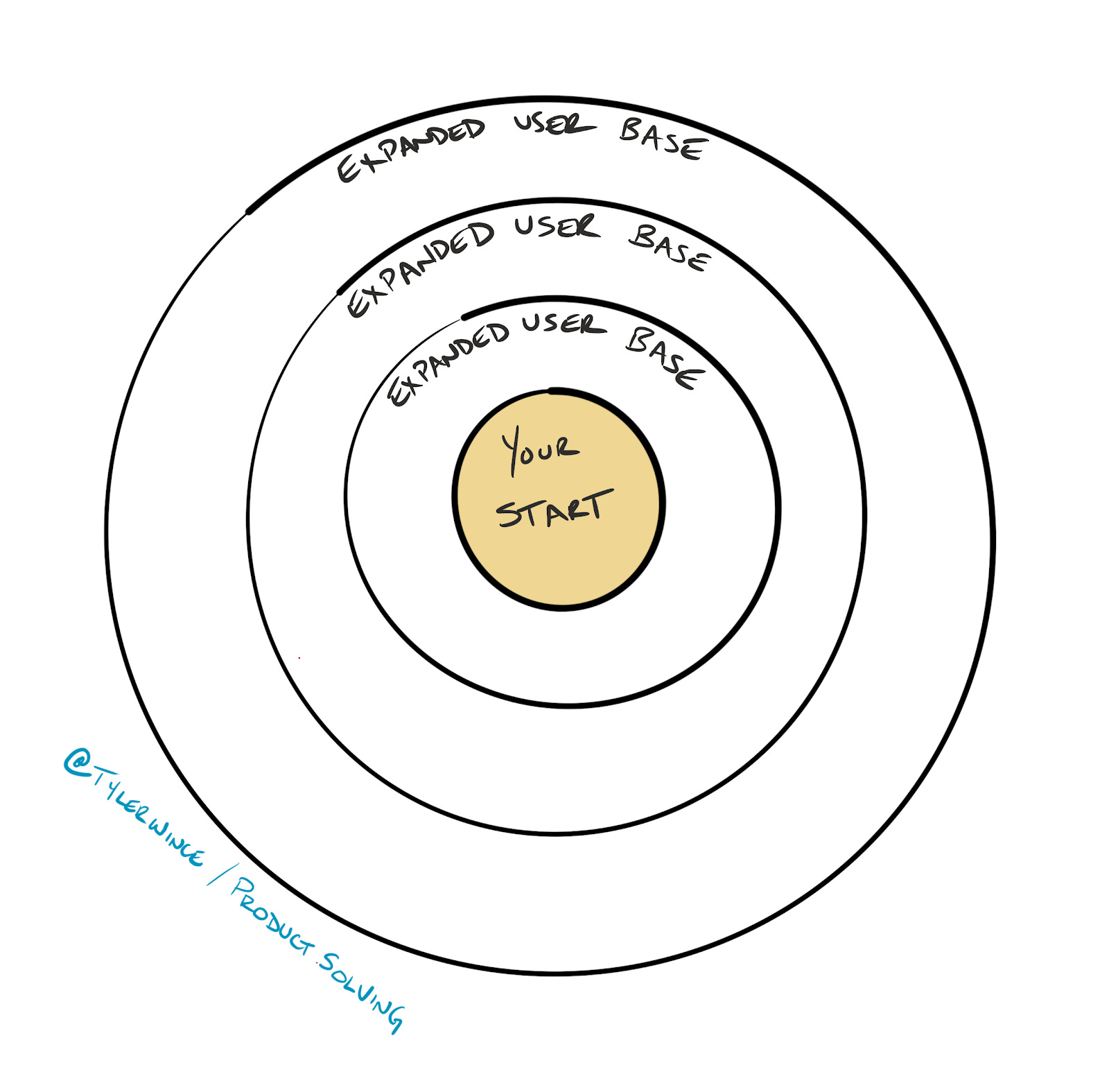

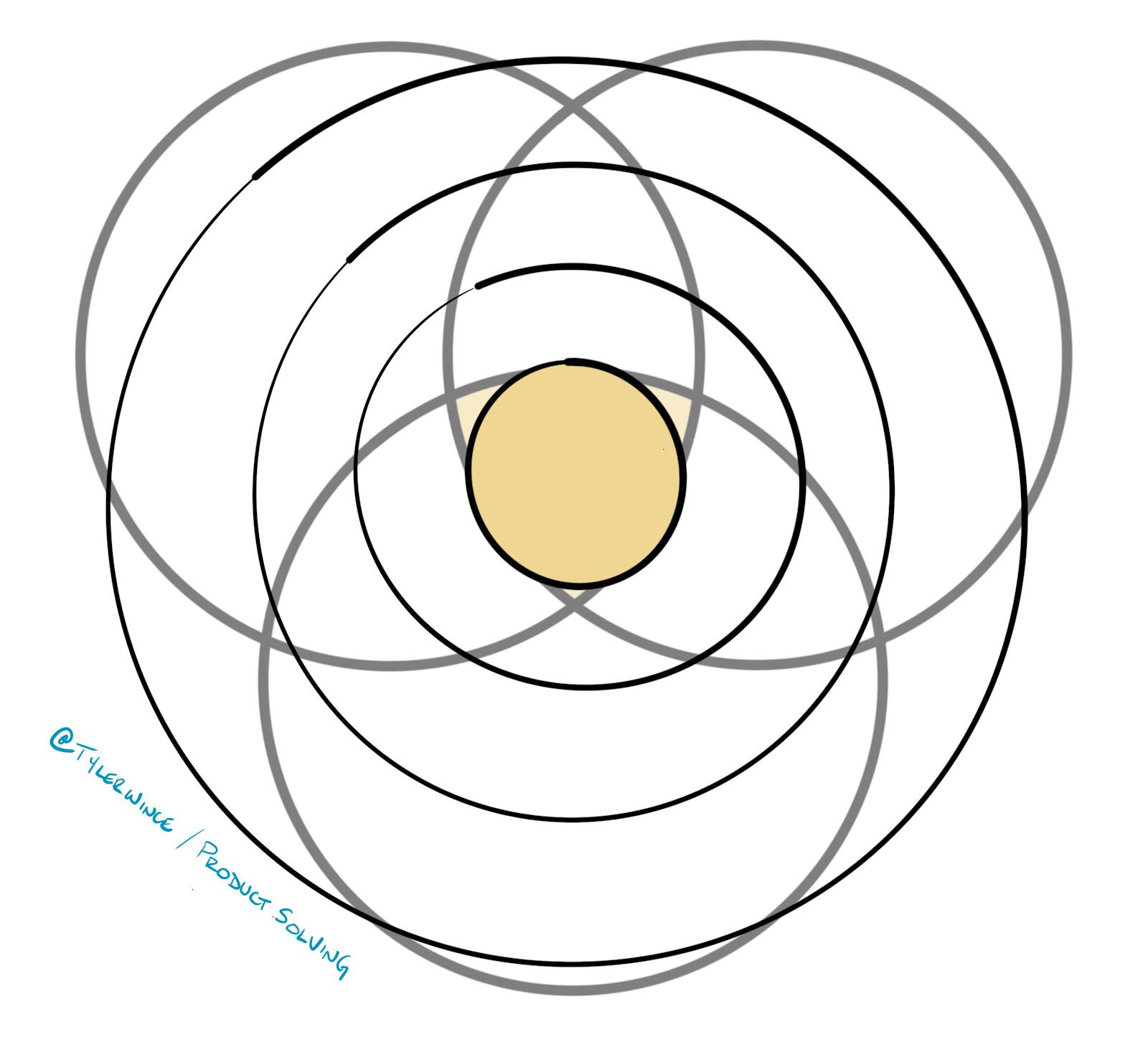

The easiest way to get a monopoly is to build a product that is at the intersection of numerous things. Your user base is small, but in need and you can serve them with a product that they will love forever. Once you have dominated this market, you can start to scale. Envision concentric circles with an ever-growing market share as you expand. You start small and niche, grow large and dominant.

This is where the idea of “escaping the competition” (also by Thiel) comes from. Your goal as a business should be to not have any competition. You want to have a monopoly on the market.

Every small company, niche, and non-monopolistic will tell people they have a monopoly at the intersection of a handful of industries. Every monopolistic company will tell people they are not a monopoly because their business is the union of a handful of industries. Most large successful companies go through this transition in their company lifetime where they slide from small, niche, and non-monopolistic into something large, successful, and monopolistic.

Understanding the Market Space

Once you have defined your market landscape (who you are going to sell to) you will need to make sure the product you build serves their needs better than anything else in the market. Two companies that have the same problem statement, but different market spaces will come up with a product that looks, feels, and behaves completely differently. In fact, many would think these companies are not even competitors in some cases because of the large differences in their products (think of the email apps Superhuman and Hey - case study on this is below).

But this is only enough to get started. Once you have dominated the market space you have defined, you have to shed that exoskeleton and grow into a larger, more competitive one. This means moving out of your smaller concentric circle and into one that is larger and has more potential. However, more potential means more competition.

Your users here likely have the same problem, but their outlook on that problem may be different. You will need to do a combination of two things as a product manager: 1) sell them on your vision for the solution to the problem and 2) tweak your product to fill the gaps where you can’t.

Selling them on your vision for the product

April Dunford has some of the best strategy and thinking around this. Your job is not only to sell the best solution in the market, but you also need to convince your users why your point of view is the best and how that inevitably makes your vision the best.

You need to tell a compelling story about why you are solving the problem in a way that the users want to experience it.

Your point of view of the market gives customers a chance to walk in your shoes. You want to tell them why you prioritize certain features, who the optimal user of your product is, and why that combination will lead to a meaningful impact for them. Your users will have never purchased or used a product like yours, so you will end up spending a lot of time educating them. Give them your point of view, how it compares to your competitors, and why your point of view is better.

Fill the gaps in your product

Your new market is going to have needs that your previous market didn’t have. You should be looking ahead and anticipating these needs. Add some of the more critical ones to the product before you launch into the market or you won’t stand a chance.

The best way to think about this is to think in terms of the Kano Model. The Kano Model tells us there are three kinds of features: necessary, expected, and surprising. You should begin market research to identify what types of features fall into each of these categories before you launch into your new market. Querying your future customers for insights on their workflow and problems will help you determine which features are necessary, expected, and surprising. Bucketing features in this way will help minimize feature bloat while ensuring your product meets the basic needs of your customers.

This does not mean you are going to do all of them, in fact, you shouldn’t. You are selling a vision that completely changes the way they work. Don’t compromise that vision because they tell you something is necessary. It may not be. But, you should do a few things:

Be sure you have all the necessary features baked.

They just won’t use your product if you don’t. These are the types of features that provide a user the basic needs to do their job. Necessary features are like the wheels on a car, the product doesn’t work unless you have them.

As a product manager, you should be communicating with the business to determine what markets you are tackling next, begin doing your market research early, and get these things into the product.

Have a surprising feature as well

If you add in a surprising feature, you will win over customers that you didn’t think would leave their current solution. You should do some competitive analysis to determine what features your competitors have and build something different. Don’t overlap on this one. Stand out, build something compelling, and win your users with this.

Making the move

Once you have done this, you are ready to make the move into the next market space. You should ship early, often, and get as much feedback as possible. Your new customers will have complaints, and that is okay. Determine the right way to handle any complaints by separating the ones that are meaningful from the ones that aren’t aligned with your vision. A great way to do this is by using a product sieve, which I wrote about a few weeks ago.

Securing your monopoly for the long haul

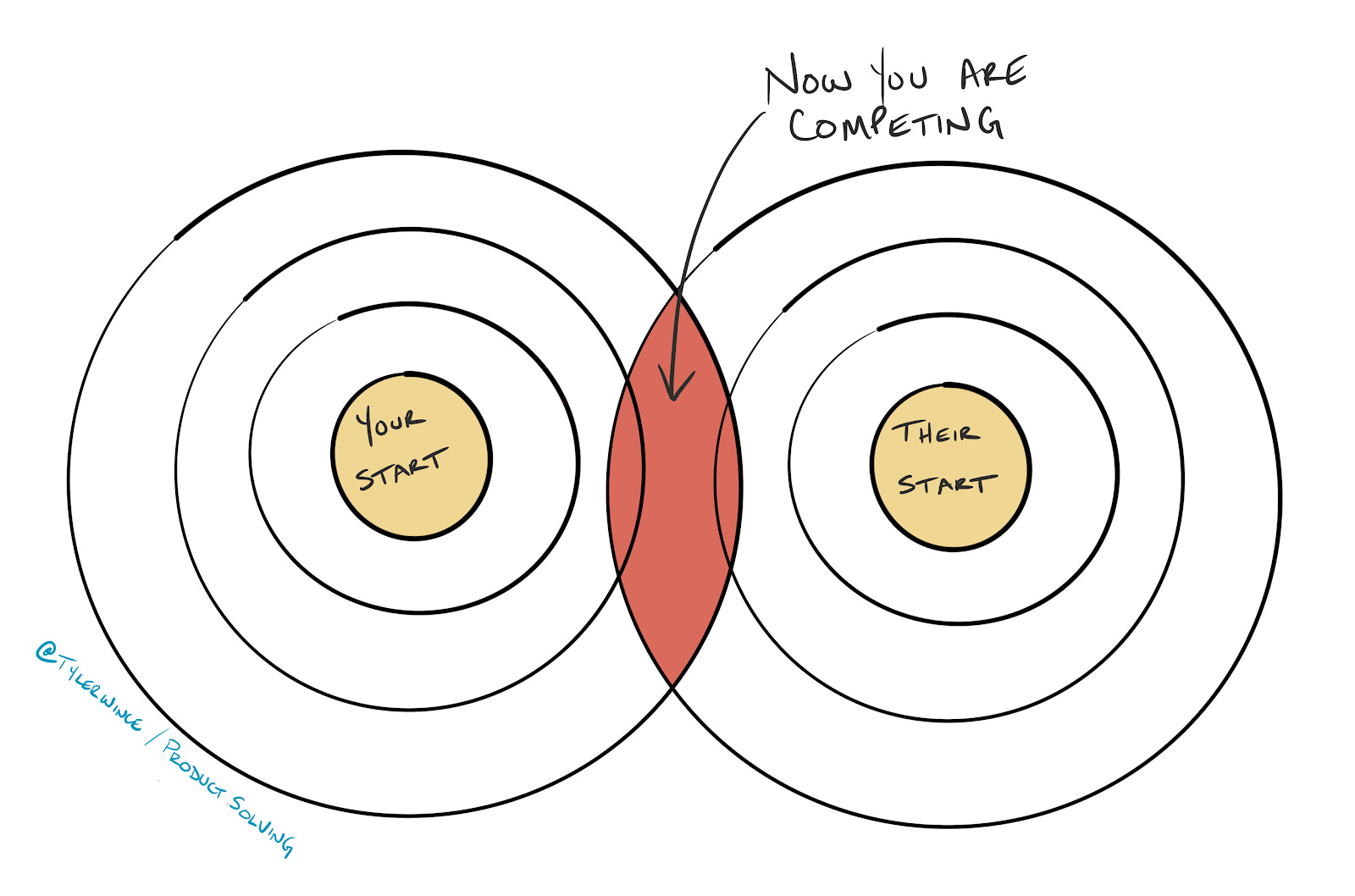

It is easy and short-sighted to only look at current competitors in the market space you are moving into. The solution your target customers use today is definitely something that should be considered, but it is not enough to ensure you win. Remember, you don’t want part of the market share, you want a monopoly.

As a product manager, what you need to be doing is researching other companies that are not yet competitors. These are companies that have the same problem space you have but a different market space and thus a different twist on the solution. They may have different corporate values due to the market space they entered into, and they will sell the product differently because of that.

You should be looking at these “non-competitors” as your main competition for the future. They, too, are building their niche monopoly, growing into further concentric circles, and if you have the same problem space, your circles are going to overlap. This means that while you may not be competitors yet, you will be. And remember, you don’t want to have part of the market share, you want the monopoly. This means that one of you is going to win, and one will be left sucking wind wishing they had looked far enough ahead.

Leaving your problem space and strategy open enough

I wrote recently about defining a product sieve, and how important that is for building a good product. This becomes critical when you start to see your job as something that needs to consider not only current markets, but future markets and the changing demands that may put onto your product.

You will have to make changes to the way your product delivers value. Don’t lock yourself into a single strategy that will force you to lose. You don’t want to be Blockbuster who didn’t move into the age of the internet with the right strategy. Winner takes all, and Netflix won.

Case Study: Blackberry and iPhone

Blackberry and iPhone were two completely different devices solving the same problem in completely different ways. They both started out to do “computer” activities away from your computer. For Blackberry, this meant things like sending emails and consuming basic parts of the internet. For the iPhone, this meant consuming content. One was work and the other was fun.

The problem space was the same though — I need to do computer stuff away from my computer.

As the market space grew for iPhone and Blackberry, they began to compete. The iPhone started being more valuable for work, and Blackberry needed to find a way to keep up on content consumption. Unfortunately for Blackberry, we know how this ends… there is a reason I am writing half this post on an iPhone and not on an Evolve(?).

iPhone left their product strategy open enough to handle the future concentric circles they moved into. They built a device that was touch-only when business people said it “wasn’t possible for a work device to not have a physical keyboard”. They built work applications like mail and calendar into the app when their current target market underutilized the apps. They were thinking forward into the next circle and what was needed.

Blackberry on the other hand, added full-screen support later (remember the Blackberry Storm?…yikes). They were retrofitting their devices with features that were required for entry to the next circle, but they didn’t fit into their sieve. They realized they had started too well-defined and missed the opportunity.

Case Study: Hey and Superhuman

Let’s look at a more recent case study that hasn’t panned out yet, Hey and Superhuman.

Both apps have the same problem space. They both are solving for a default email experience that sucks where people want to get through their mail faster and in a more enjoyable way. Both companies limit their target market out of the gate to only people who are willing to pay money (a lot of it) for a different default experience. However, within that, they both have different niches and target markets and thus, aren’t competitors… yet.

Superhuman is after the executive who spends the majority of their day in email. They have a GSuite account for work and need to find a faster way through their inbox. They get hundreds of emails a day, some valuable, some not. They need to identify which emails are actionable, which are informational, and which need responses. And they need to do it all right now.

Hey on the other hand has a market of privacy-focused technologists. They don’t want to get through their email by using shortcuts, they want to get through it faster by getting less email. They don’t care about abandoning their email address for a nice, shiny @hey.com badge of tech nerdom. They just want email to be fun and relaxing, not stressful and anxiety-ridden.

Two completely different apps, built for different experiences, workflows, and cost, solving the same underlying problem. Superhuman has done a good job of capturing a lot of the tech market in their niche. They have their small monopoly and are probably looking at what comes next. Hey, on the other hand, is still too new to determine if they will get that monopoly on their market.

The real test for both apps will be how they respond to growing their market space. To continue growing their user base and their ARR, they will need to open up to a new target market. Doing this means they will soon find themselves competing. Superhuman needs to find a way to appeal to them more.

The goal for both companies should be to figure out where the concentric circles will connect. What market space they will be targeting when that happens, and to get started early by building features that start to draw that market in as early as possible. They both have something to learn from Apple and Blackberry… even if they start out with different market spaces, one of them is going to win and the other is going to Blackberry. Don’t be Blackberry.

So what?

As a product person, you need to do the following things to keep ahead of the curve.

-

Dominate your current market space. None of the rest matters if you can’t do that.

-

Stay ahead of the needed features for your future market space. You just won’t get any users if you don’t have their needed features.

-

Work with your marketing team to sell the vision, not just the features. Every time you enter a new market, you will lose on features. Other companies have been there for longer than you and have more features than you. Win on the story and viewpoint of the problem.

Keep your eyes down-road. Don’t spend all your time looking in the rear-view mirror and miss where you are headed. Dominate your market, start building for the next, expand the market, and repeat. You will find yourself escaping competition by carving out your monopolies along the way. Keep moving from owning a monopoly on the intersection of industries to a monopoly on the union.